How can homebuyers save money when mortgage rates & home prices fluctuate to extremes?

Buying a home is an expensive endeavor, especially in today’s markets. Mortgage rates have just barely hit a reasonable range, but home prices are climbing yet again. For homebuyers determined to become homeowners this year, there are a few ways you can cut costs and lower your mortgage payments, that might make it a more achievable goal…

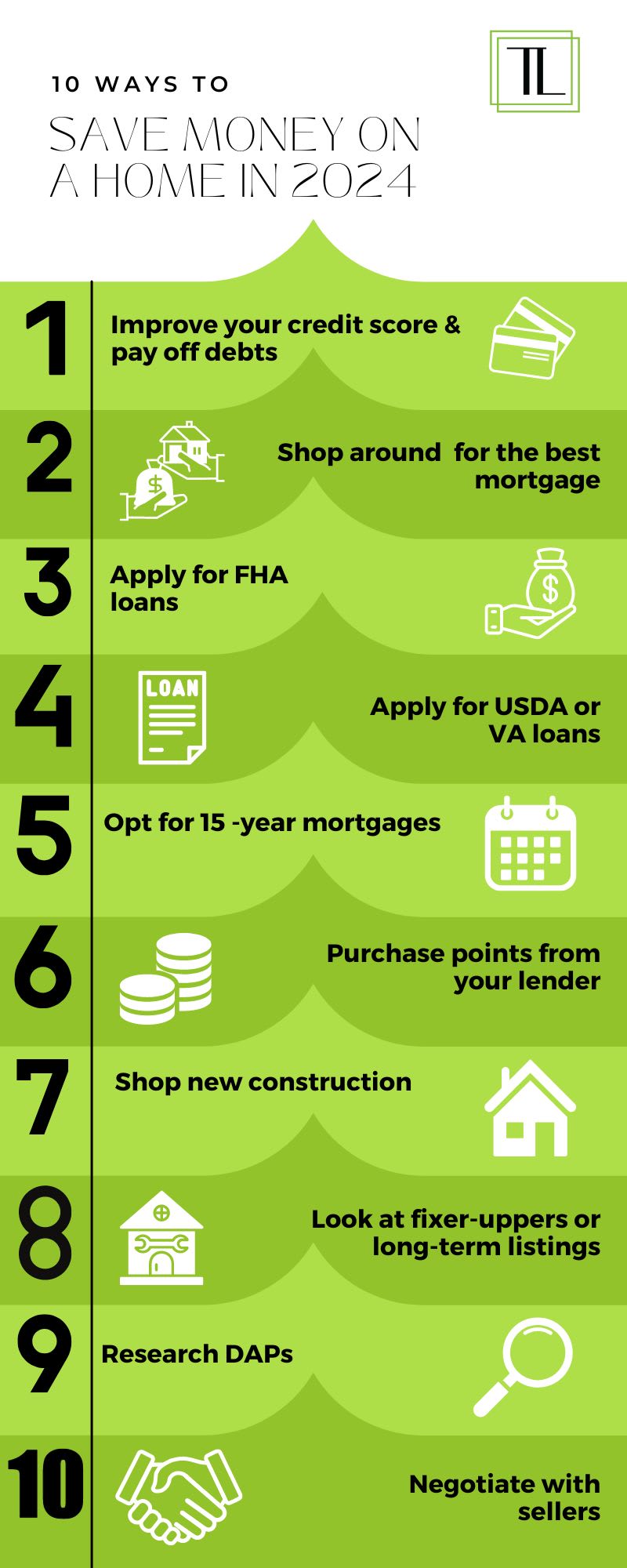

Here are 10 tips to help save you money when buying a home:

1. Improve Your Credit Score & Pay Off Debt

Paying off old debt might not seem like a way to “save” money, but lenders are less worried about borrowers defaulting on their loans if they’ve proven they can pay off their debts in a timely manner. This will also improve your credit score, giving you a higher chance at a better home loan.

2. Mortgage Shopping

Homebuyers tend to think they’re stuck with the lender who wrote them their mortgage loan pre-approval letter, or that all lenders are the same. However, not all lenders are created equal… And you can save thousands of dollars over the life of your home loan by making lenders compete over your business! With fewer borrowers seeking home loans due to higher home prices, lenders may be more willing to give you a break.

If you’re still looking for a lender to help you save money on buying a home, contact us to get in touch with one of our preferred lending partners.

3. FHA Loans

FHA loans, or Federal Housing Administration loans, are an extremely popular way for first-time homebuyers to get help making the large down payment for a new house. With an FHA loan, buyers can put as little as 3.5% of the purchase price as a down payment! Plus, they can often get lower mortgage rates than those with conventional home loans.

However, there are cons to FHA loans. You typically have to pay private mortgage insurance every month, approvals require a strict home inspection, and you must have a minimum 580 credit score to qualify for putting the 3.5% down, just to name a few.

You can get more info about FHA home loans and see if you qualify here.

4. USDA or VA Loans

If you qualify for a VA or USDA loan, you could be able to buy a home with 0% down! Both active-duty and veteran military personnel (and their spouses) can qualify for a VA loan, or a Veterans Affairs loan. If you’re buying a home in a rural area, you could qualify for a USDA loan, or U.S. Department of Agriculture mortgage loan. Both these home loans typically don’t require any down payments, come with lower mortgage rates, and don’t usually require private mortgage insurance. They're an excellent way to save money on a home!

You can get more info on VA loans and see if you qualify here.

To see if you qualify for a USDA loan, get more info here.

5. 15-Year Mortgages

Choosing a 15-year mortgage loan can result in higher monthly payments, but will usually save you a lot of money on a home in the long run. The mortgage rates on these home loans are generally much lower than those on 30-year fixed-rate mortgages. You can also pay the home off in half the time!

6. Mortgage Points

Purchasing mortgage points from your lender can cost more upfront when taking out the home loan, but it can also permanently lower your mortgage payments and save you quite a bit of money on your house every month. Point systems can vary, so check with your specific lender, but points are typically sold in 0.25% increments at about 1% of the total mortgage.

7. New Construction

Although the purchase prices can be higher for new build homes than a similarly sized home on the market, homebuyers can often end up with lower monthly mortgage payments than with “used” homes. Many home-builders are buying mortgage rates down either permanently or through temporary buy-downs. And national home-builders often have lending partners that make it easier to provide mortgage savings to their buyers. Plus, new construction homes aren't as costly as many buyers believe!

8. Down Payment Assistance Programs

There are over 2,000 DAP, or down payment assistance programs, available across the country for qualifying repeat and first-time homebuyers. These programs help buyers based on their income, professions, military service, heritage, disabilities, and more.

You can get more info on DAPs in the Houston area and how they can help you save money when buying a home here.

9. Long-Term Listings & Fixer-Uppers

Most homebuyers want a cute, move-in-ready home with a gorgeous yard and updated fixtures. But, there’s often a lot of potential in an attractively priced “fixer-upper”, or even a house that’s been sitting on the market for a while. Remember, cosmetic problems—like wall paint color, peeling trim, or door style—are easy things to fix. As long as the home passes inspection and you understand the amount of work that may be needed, there’s no reason these houses can’t be the home of your dreams. Besides, with all the money you’re saving on the purchase price, you could turn it into a really beautiful home!

10. Negotiate

Don’t let the competitive housing market fool you… You can always attempt to negotiate with home-sellers! Nothing ventured, nothing gained, right? Keep in mind, this probably isn’t the best strategy for well-priced homes with massive curb appeal, or listings in popular neighborhoods. But sellers of homes that have been sitting on the market for a while, older homes, or houses in less desirable locations might be willing to work out a deal with you.

If you’re interested in buying a home this year (or ever), check out the current listings of Texas Living Company! You can count on our incredible team to help you in any way possible to make your dream of homeownership a reality.

Alexis Feezel is a results-oriented Marketing Coordinator responsible for developing, implementing, and overseeing all promotional strategies and activities to effectively market clients & listings and maximize sales.